Bank Business Continuity Software | WebEOC by Juvare

Transform Your Resilience and Continuity with Juvare

WebEOC helps financial institutions reliably track and mitigate emergencies by bringing all stakeholders and data into a single operation center.

The challenge today

The Three Critical Challenges Every Financial Leader Faces

From business continuity risks to operational disruptions and ever-evolving compliance demands — financial institutions must coordinate fast, protect sensitive systems, and remain audit-ready at all times.

Managing Disjointed Systems During Disruptions

Navigating a disruption — from cyberattacks and outages to natural disasters — requires financial institutions to coordinate rapidly across branches, data centers, and departments without missing a beat.

Responding to Disruptions Across Locations

Without preventative workflows and centralized visibility across branches, financial institutions can find themselves playing catch-up after system downtime and disruptions, damaging customer trust and compliance standing.

Lacking Unified Situational Awareness

Manual processes and disconnected systems create blind spots across locations, compromising swift decision-making, executive-level reporting, and regulatory compliance during critical incidents.

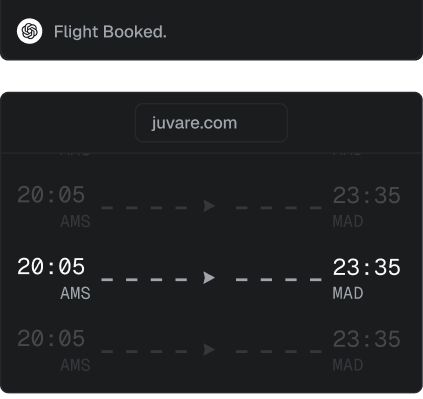

Banking Workflows Designed to Work On Day One

Safeguard operations, respond to emergencies, and maintain audit-ready continuity plans with boards built for the financial sector — tested across banks, insurers, and capital market institutions.

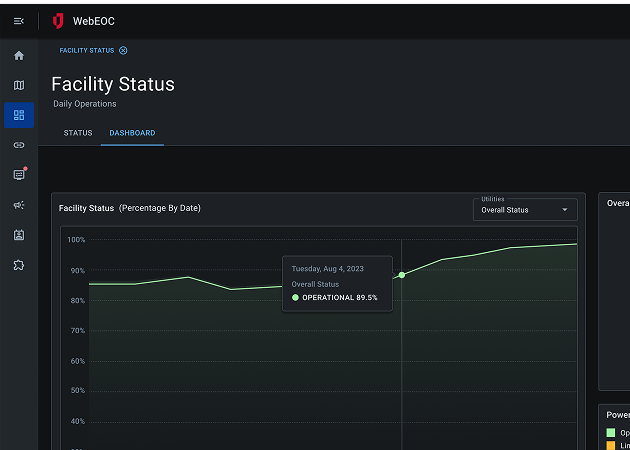

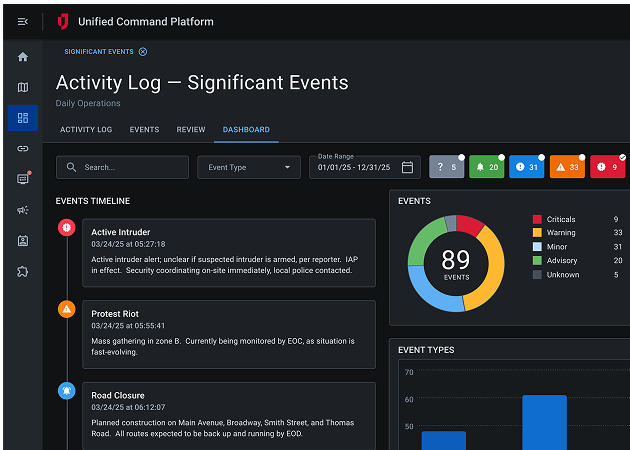

Monitor Branch & Data Center Status in Real Time

Track infrastructure uptime, site access, and business continuity metrics with integrated data across branches, HQs, and data centers — from cyber threats to regional outages — all from a single WebEOC dashboard.

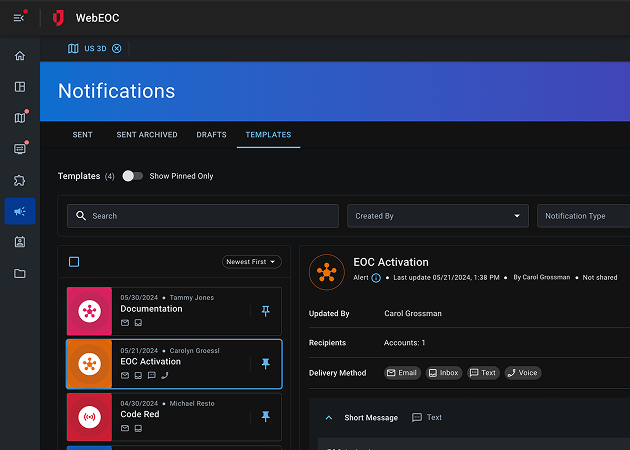

Activate Continuity Plans with a Click

Launch playbooks for ransomware, DDoS, protest threats, or natural disasters instantly. Juvare’s bank business continuity software comes with pre-assigned roles, workflows, and notification paths ready to execute.

Communicate Across Business Lines Instantly

Distribute critical updates to HR, Security, IT, and Facilities in one platform. Escalate to executive leadership or regional managers in seconds — with full audit logs and status tracking.

Coordinate External Vendors & Partners

Whether it’s backup generators or third-party call centers, track vendor roles, contact info, and real-time updates in one place — ensuring smooth coordination even during supply chain shocks.

The Juvare Solution

Complete Incident Response and Emergency Management

Centralize incident response across all teams and locations, from cyber threats to facility disruptions, with real-time coordination and automated compliance reporting.

Cyber & Fraud Incident Management and Response

When seconds matter, WebEOC centralizes incident management across IT, security, and operations — from ransomware to wire fraud to phishing campaigns. Maintain audit trails, assign actions, and escalate instantly.

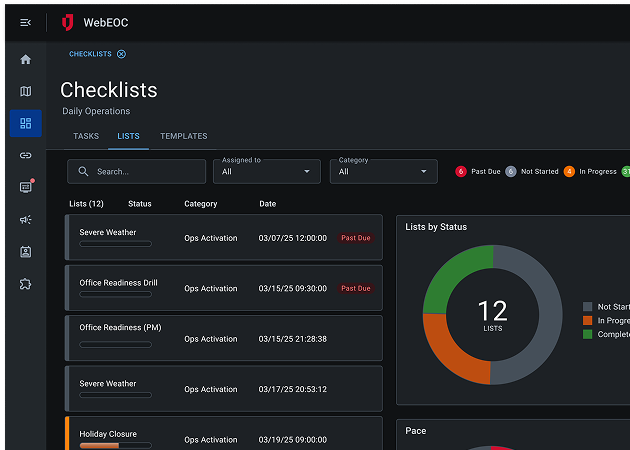

Branch & Data Center Disruptions

Whether it’s a power outage, system failure, or vendor disruption, WebEOC gives HQ a real-time view into affected branches and facilities, with incident logs, escalation workflows, and executive dashboards.

Enterprise-Wide Crisis Coordination

Cut through silos between Risk, Compliance, Security, and Business Continuity teams. Share updates, assign recovery tasks, and track SLAs — all while maintaining role-based access control.

Regulatory Documentation & Stakeholder Reporting

Automate situation reports and compliance documentation for regulatory agencies, audit committees, and internal leadership — no more scrambling to piece together timelines from emails and spreadsheets.

Talk to an Industry Expert

Connect with specialists who understand your operational challenges and can show you how financial institutions use Juvare to coordinate response, manage resources, and maintain continuity.

Built to Match Your Operations

Configure financial resilience workflows that actually fit how your teams work, with expert support to customize every process.

DesignStudio

From fraud escalation playbooks and cyber event logs to executive briefings and branch outage tracking — DesignStudio helps resilience and continuity stakeholders configure workflows in minutes, without IT help. Update forms, processes, and dashboards to stay audit-ready and agile.

Intelligence Suite

Leverage Juvare Analyze and Juvare AI to surface patterns in incident trends, branch closures, or regulatory exceptions. Get auto-generated dashboards that prioritize response — whether it’s a service disruption or a compliance hotspot.

Professional Services

Our experts translate FFIEC, SOX, and internal audit protocols into real-world, reportable workflows inside WebEOC. Whether you’re aligning with continuity regulations or managing risk from cyberattacks, we’ll help you build boards that match how your teams actually work.

Thought Leadership

Read More About Juvare, Critical Operations Software, and the Work We Do

From pandemic response to election coordination to large facilities management

Operational Resilience for a 24/7 Financial World

Ensure business continuity and safeguard critical financial operations in an always-on global economy